Healthcare providers may encounter a variety of fraudulent practices. These medical frauds can harm a practice both financially and legally.

A fundamental coding error, such as incorrect CPT codes or upcoding and unbundling, might result in a regulatory probe and severe penalties, including imprisonment.

Every medical practice must be aware of intentional or unintentional fraud to avoid such consequences.

You’re worried that your staff may have engaged in billing errors like upcoding. In that situation, conducting your internal investigation and stopping the issue is crucial.

This blog post discusses what upcoding is and how to avoid it.

What is Upcoding in Medical Billing?

Upcoding is a term used in medical billing to describe the practice of submitting incorrect billing codes to an insurance company in order to receive higher reimbursement. Providing wrong Current Procedural Technology (CPT) codes indicates the expensive, complex, and time taking treatment given by a physician to a patient.

Upcoding is undoubtedly an illegal activity and is considered a healthcare fraud. It violates the False Claims Act (FCA) because it defrauds federal programs, including Medicare, Medicaid, and Tricare.

The number of CPT codes used by healthcare providers is close to 10,969. These codes indicate all the treatments, ailments, and medications the health insurance market is now willing to pay for.

The cost of healthcare services varies depending on the urgency of the problem and the complexity of the decision-making involved by the healthcare practitioner. This is the basis on which Medicaid and Medicare reimburse providers. The cost of healthcare services varies depending on the urgency of the problem and the complexity of CPT codes.

For instance, a CPT for a quick, minor medical question answered by a nurse in five minutes would be different and less expensive than one for a thorough, 45-minute examination by a doctor. However, upcoding would occur if the doctor billed the federal programs for the more extended, more expensive 45-minute assessment during the shorter consultation.

Difference between Upcoding And Unbundling

| Aspect | Upcoding | Unbundling |

| Definition | Refers to the assignment of billing codes representing a more severe, complex, or expensive service or condition than what was provided or diagnosed. | Refers to billing multiple procedure codes for services that should have been billed under a single, comprehensive code. |

| Billing Effect | Results in higher reimbursement for a specific service or condition by representing it as more severe or complex than it is. | It results in higher reimbursement by breaking down a bundled procedure into its components and billing each separately. |

| Reason for Occurrence | This might occur due to intentional misrepresentation to inflate reimbursements or unintentionally due to clerical errors or misunderstandings of coding guidelines. | Often done intentionally to maximize reimbursement. However, it can sometimes be due to misunderstandings about how to bill certain services. |

| Detection | Detected through audits, whistleblower complaints, or data analysis that reveals anomalies in billing practices. | Detected when payers notice the simultaneous billing of services that are typically bundled into a single charge. |

| Impact on Patients | This can lead to higher patient bills, especially if the patient’s insurance doesn’t cover the entire amount. Misrepresents the patient’s medical record, which could impact future care decisions. | This might result in patients being overcharged for services, especially if they are responsible for some costs. |

| Legal implications | Considered a form of fraud, upcoding can result in significant legal consequences, including both civil and criminal penalties. | Unbundling, as a deceptive billing practice, can lead to fines, penalties, and legal actions against the healthcare provider. |

How Upcoding Occurs?

When a provider intentionally utilizes incorrect codes to generate a higher fee, this is known as upcoding. Upcoding can take many different forms, such as:

- Using the code for a new patient instead of an established patient, who pays at a higher rate.

- Using the code for a doctor when the patient meets someone with lower rates.

- Using a more complicated, pricey service than the service provided.

- Including the codes for additional services or diagnostics that were either medically unnecessary or not provided.

- Using numerous codes to account for one service.

The provider represents that each service on the bill was given as coded when the payer received the bill. Making false statements on an account to fraudulently enhance payments is a severe violation, regardless of whether the payer is a commercial insurer or the government.

Penalties for Upcoding in Medical Billing ⚠️

If convicted of upcoding, you could face several penalties depending on the nature and severity of the crime.

False Claims Act Penalties

Under the False Claims Act, most upcoding crimes lead to incarceration for up to five years and fines worth up to $250,000.

New York State Penalties

Each state has additional penalties. For example, in New York, upcoding is a misdemeanor or felony with varying degrees of punishment dependent upon the amount of money that was obtained illegally and is laid out as follows:

- Fifth degree – Misdemeanor, Under $3000 in a year

- Fourth degree – Class E felony, Over $3000 in a year, no jail but up to 4 years of probation

- Third degree – Class D felony, Over $10,000 in a year, no jail but up to 7 years of probation

- Second degree – Class C felony, Over $50,000 in a year, no jail but up to 15 years of probation

- First degree – Class B felony, Over $1,000,000 in a year, Minimum one year in jail, maximum 25 years in jail

Difference between Downcoding And Upcoding

| Aspect | Downcoding | Upcoding |

| Definition | Downcoding refers to assigning billing codes representing a less severe, less complex, or less expensive service or condition than provided or diagnosed. | Upcoding refers to assigning billing codes representing a more severe, complex, or expensive service or condition than what was provided or diagnosed. |

| Consequence to Provider’s Revenue | Results in reduced reimbursement for the services provided. | Results in increased reimbursement for the services provided. |

| Risk to Providers | While it reduces revenue, downcoding often poses less risk of penalties because it errs on the side of undercharging. | As a form of fraud, upcoding can lead to severe penalties, including financial fines, loss of licensing, or legal actions. |

| Reasons it Occurs | It may result from a lack of documentation, oversight, or errors in coding. It is sometimes done intentionally to avoid potential scrutiny or audits. | Often results from intentional misrepresentation to inflate reimbursement. This can also occur due to clerical errors or misunderstanding of coding guidelines. |

| Impact on Patients | Patients might not see a direct impact on their bills, but their medical records’ overall quality and accuracy might be compromised. | This can lead to higher patient bills, especially if the patient’s insurance doesn’t cover the entire amount. Misrepresents the patient’s medical record, which could impact future care decisions. |

| Detection | Often detected by insurance companies during audits or by healthcare providers reviewing their records and noticing underpayments. | Detected through audits, whistleblower complaints, or data analysis that reveals anomalies in billing practices. |

| Legal implications | While not as commonly pursued legally since it doesn’t lead to overcharges, consistent or intentional downcoding can still have legal implications. | Because it’s a fraud, upcoding can result in significant legal consequences, including civil and criminal penalties. |

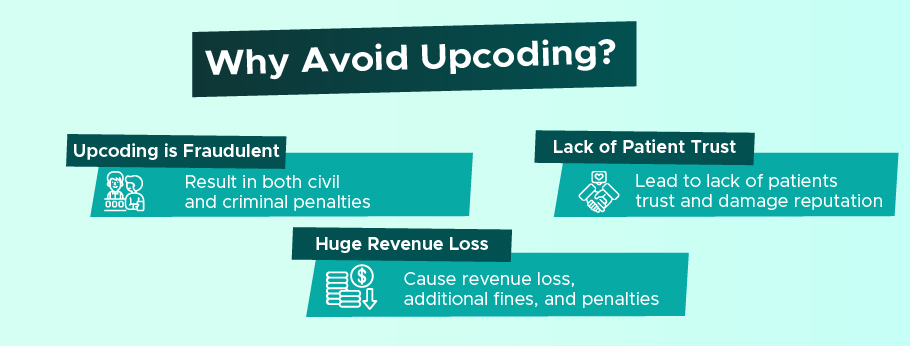

Why Is It Essential for Practices to Avoid Upcoding?

Upcoding poses several risks, both ethically and financially. Practices need to engage in accurate coding and billing processes to uphold their ethical responsibilities to patients. This will ensure their long-term viability and success in the healthcare industry.

Here’s why practices must avoid upcoding:

Upcoding is Fraudulent

Upcoding is considered healthcare fraud. When a provider submits claims with false information to obtain higher payments than they’re entitled to, they are breaking the law. In many jurisdictions, this can result in both civil and criminal penalties.

Healthcare practices are often subjected to audits. If upcoding is discovered during these audits, it can lead to significant legal and financial penalties. Moreover, repeated offenses can attract more scrutiny, making the establishment a regular target for future audits.

Lack of Patient Trust

Trust is eroded when patients learn that a healthcare provider is billing for services they didn’t receive. This can lead to the loss of patients and a tarnished reputation in the community.

Patients today are more informed and have access to their billing details. If they spot discrepancies and realize they’ve been charged for services they didn’t receive, it could lead to complaints, negative reviews, or even legal actions.

Trust is the foundation of the patient-provider relationship. Upcoding practices can jeopardize this bond, making it hard for patients to believe in the care they’re receiving. As a result, patient retention and loyalty could be severely affected.

Huge Revenue Loss

Providers may need to pay back the excess reimbursement they received when upcoding is discovered. This not only results in a loss of that revenue but often includes additional fines and penalties, which can be substantial.

Many providers have contractual agreements with insurance companies. Engaging in upcoding can be grounds for termination of these contracts, leading to a substantial decrease in patients and revenue.

If a practice is taken to court over fraudulent billing, it will likely incur significant legal fees. Even if the practice is not found guilty, the cost of defending against such allegations can be extreme.

Do you know? 💡

The FBI is the primary agency for investigating healthcare fraud for federal and private insurance programs. The FBI investigates these crimes in partnership with:

- Federal, state, and local agencies

- Healthcare Fraud Prevention Partnership

- Insurance groups such as the National Health Care Anti-Fraud Association, the National Insurance Crime Bureau, and insurance investigative units

Difference between DRG Upcoding and CPT Upcoding

| Aspect | DRG Upcoding | CPT Upcoding |

| Definition | Refers to assigning a diagnosis code corresponding to a more severe condition or one requiring a higher level of care than what was diagnosed or necessary. | Refers to the assignment of a procedure code that indicates a more complex or expensive procedure was performed than what was done. |

| System Used | Used in the inpatient hospital setting. DRGs group patients with similar clinical problems who are expected to consume similar hospital resources. | Used primarily in the outpatient and physician settings. CPT codes represent medical, surgical, and diagnostic services and procedures. |

| Purpose of Coding | Determines the fixed reimbursement amount for inpatient hospital stays based on the patient’s diagnosis and other factors. | Determines reimbursement for individual procedures or services rendered by healthcare professionals. |

| Consequence of Upcoding | Results in a higher payment to the hospital for the inpatient stay. | Results in higher reimbursement for the specific procedure or service rendered. |

| Detection | Insurance companies or CMS may analyze patterns of DRG assignments, and discrepancies when compared to the actual medical records, can raise red flags. | Insurance reviews or audits that compare CPT codes billed to actual procedures documented in the medical record can reveal discrepancies. |

| Legal implications | Due to the potential for significant overbilling, DRG upcoding can lead to substantial fines, penalties, and even legal actions against the offending hospital. | CPT upcoding, considered a form of fraud, can lead to fines, penalties, and legal actions against the offending healthcare provider. |

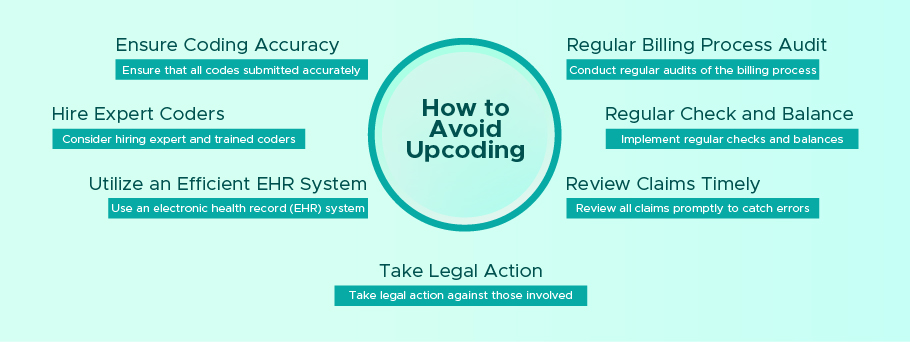

7 Tips for Healthcare Providers to Avoid Upcoding

Here are 7 tips for healthcare providers to avoid upcoding:

Ensure Coding Accuracy

Ensure that all codes submitted accurately reflect the procedures performed. This can be achieved through regular training and education for staff members responsible for coding and implementing checks and balances to catch errors.

Regular Billing Process Audit

Conduct regular audits of the billing process to identify potential issues or improvement areas. This can help catch any mistakes or fraudulent activity before it becomes a more significant problem.

Hire Expert Coders

Consider hiring expert coders trained and certified in medical coding. These professionals can help ensure all codes are submitted accurately and comply with regulations.

Utilize an Efficient EHR System

Use an electronic health record (EHR) system that is efficient and easy to use. This can help reduce the likelihood of errors and improve coding accuracy.

Regular Check and Balance

Implement regular checks and balances to ensure all codes are submitted accurately and comply with regulations. This can include regular reviews of codes by a supervisor or an independent auditor.

Review Claims Timely

Review all claims promptly to catch errors or potential issues before they become more significant problems. This can help reduce the likelihood of upcoding or other fraudulent activity.

Take Legal Action

If you suspect upcoding or other fraudulent activity is occurring, don’t hesitate to take legal action. This can include reporting the activity to the appropriate authorities or pursuing legal action against those responsible.

By following these tips, healthcare providers can reduce the likelihood of upcoding and ensure they submit accurate and compliant claims. It’s important to remember that upcoding is illegal and can result in severe penalties, so taking steps to prevent it from happening is essential.

Billing Shark – Your Expert Coding Partner to Eliminate Upcoding 🙂

Medical coding has high stakes, and mistakes can cost dearly. By partnering with Billing Shark, you’re choosing a path of assurance, reliability, and compliance.

Here’s how we ensure upcoding prevention:

➜ Experienced Team: Our team at Billing Shark is equipped with the latest coding knowledge and technologies, ensuring that upcoding is a thing of the past.

➜ EHR Integration: We combine our vast experience with state-of-the-art technology to provide error-free coding solutions. Our EHR system vigilantly cross-checks every entry, guaranteeing the highest accuracy level.

➜ Personalized Service: At Billing Shark, we understand that each healthcare provider has unique needs. That’s why we offer tailored solutions catering to your coding requirements.

Join the Future of Error-Free Medical Coding

Enter into a world without worrying about coding errors or compliance issues. Let us be your expert coding partner.

FAQs

What are the consequences of upcoding?

Upcoding can lead to various consequences, including hefty financial penalties, loss of medical licenses, potential jail time, damage to the provider’s reputation, and loss of patient trust. In some cases, repeated violations can lead to exclusion from federal health programs. In 2022, a California-based doctor, named Donald Woo Lee, was sentenced to 8 years in prison after he was found guilty of fraud billing $12 million to Medicare by upcoding.

What is an example of upcoding?

An example of upcoding is when a patient visits for a brief consultation. However, the provider bills for a comprehensive, lengthy examination, resulting in higher reimbursement than the genuinely provided.

What to do if the provider is upcoding?

If you suspect upcoding, the first step is to address the issue with the medical provider or their billing department to understand if it was an oversight or intentional. If the matter isn’t resolved or you believe the upcoding was deliberate, you can report the incident to the appropriate regulatory bodies like OIG or seek legal counsel.

What is the health law issue with upcoding fraud?

The health law issue with upcoding fraud is that it violates the False Claims Act (FCA). The FCA prohibits providers from knowingly submitting false claims to federal health programs like Medicare and Medicaid. Violation of this act can lead to both civil and criminal penalties. The healthcare system relies on trust and accurate representation of services and upcoding undermines both these principles, making it a critical legal and ethical concern.